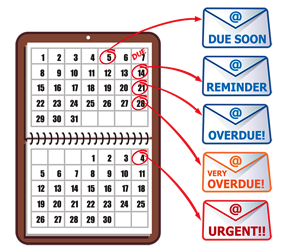

Outsourcing your credit control

Outsourcing your credit control Credit control is a vital part of running any business. A business owner has so many things to deal with when running a company that it is easy to take your eye off your finances especially unpaid invoices. How often do you check...

Bookkeeping for Sole Traders

You must keep records of all your business's income and expenses for your self assessment if you are a sole trader. What records to keep * Monthly Income - sales invoices * Monthly expenditure - all business expenses * VAT records if registered for VAT * Paye...

Do I need an accountant for my limited company?

The answer to this is no however, there are many reasons why the vast majority of limited company owners do use accountants, instead of doing the books themselves. The right accountant will save you time and money year after year. If you are just starting up the...

Setting Up as a sole trader

Sole traders must register with HMRC and follow certain rules on running and naming their business. If you’re a sole trader, you run your own business as an individual and are self employed. You can take on staff - being a sole trader means you’re responsible for the...

Tax free gifts for clients and staff

HMRC allow a business to spend £150 tax-free on each employee at the Christmas party. HMRC Rules for eligibility: Any money the company spends by inviting partners or spouses of employees is eligible for tax. This is providing the total expenditure for the party,...

Business Start Up Loans

Start Up Loans Loans and mentoring for people over 18 years old who are looking to start a business. Backed by the Business Bank. Eligibility To apply for a loan you must be: 18 years old or older when you apply living in the UK Additional information Start Up Loans...

Unable to display Facebook posts.

Show error

Type: OAuthException

Code: 190

Please refer to our Error Message Reference.